“Progressive” California Chases People Out, Then Wants To Tax Them For Leaving

Will someone please inform the leftist losers who run California that they have already revolutionized the concept of “stupid” and they can stop trying so hard to perfect “idiocy?”

Their latest unconstitutional plan to draw attention to themselves, waste taxpayer money and demonstrate their incompetence is to tax those that flee their woke gulag.

Alex Lee, a Democratic Assemblyman, got together with nine other Democrats and proposed legislation that would require “California residents” that have a “worldwide net worth” greater than $1 billion to pay an additional 1.5 percent tax that would begin in January of next year. Then as early as 2026, the threshold could drop to those with a net worth of $50 million with an imposed tax rate of 1 percent.

So Lee and his groupies believe that by dreaming up an unconstitutional tax, they can use the money to correct a $22.5 billion dollar budget deficit that they created.

According to Lee’s calculations, the tax would provide an additional $21.6 billion in revenue, but it would only effect .1 percent of the state’s population.

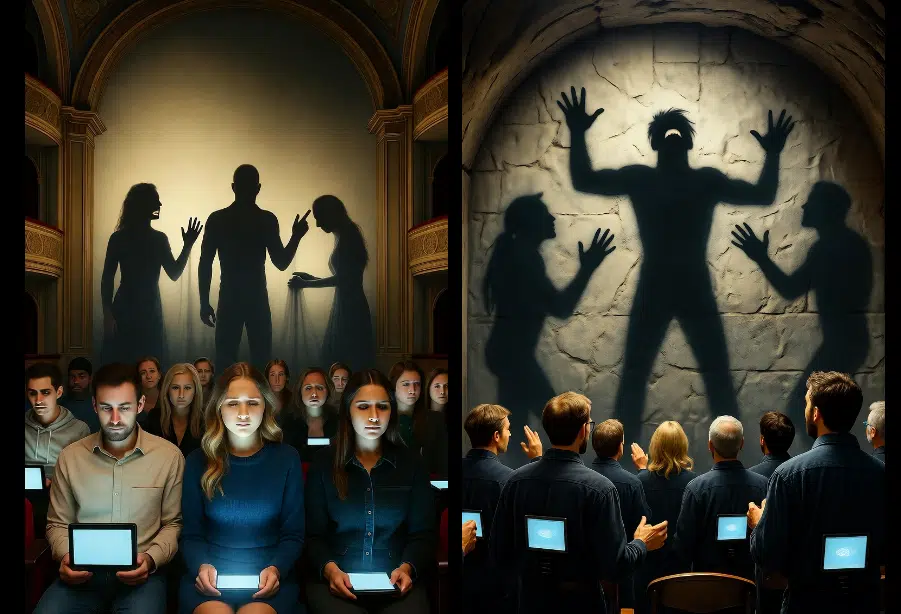

In other words, only those bad rich people would be affected. It’s an old ploy to make something unlawful sound palatable to the unaffected general public.

In a tweet Lee whined:

“Billionaires aren’t paying what they owe while enjoying public investments to build their empires. My colleagues today and colleagues from 7 other states are introducing Wealth Taxes to bring tax justice. #TaxTheRich.”

The fact that 7 other states jumped into the moron pool proves nothing. Except, like lemmings, they are following California over the cliff of reason.

I’m not sure of the wording in the legislation of the other states, but California’s contains provisions that would require tax payments on a person’s assets even if they leave the state.

Jared Walczak, the Vice President of state projects at the Tax Foundation, can see through this farce. He believes it will not only drive more people out of the state but will also be too costly to implement.

“The proposed California sales tax would be economically destructive, challenging to administer and would drive many wealthy residents and all of their current tax payments out of state,” he says. “The bill sets aside as much as $660 million per year just for administrative costs, more than $40,000 per prospective taxpayer, giving an idea how difficult such a tax would be to administer.”

So. Unbelievably expensive, impossible to actually administer and last but not least, unconstitutional.

That’s California.