Can’t a Business Ever Just Fail, Simply Because It Failed?

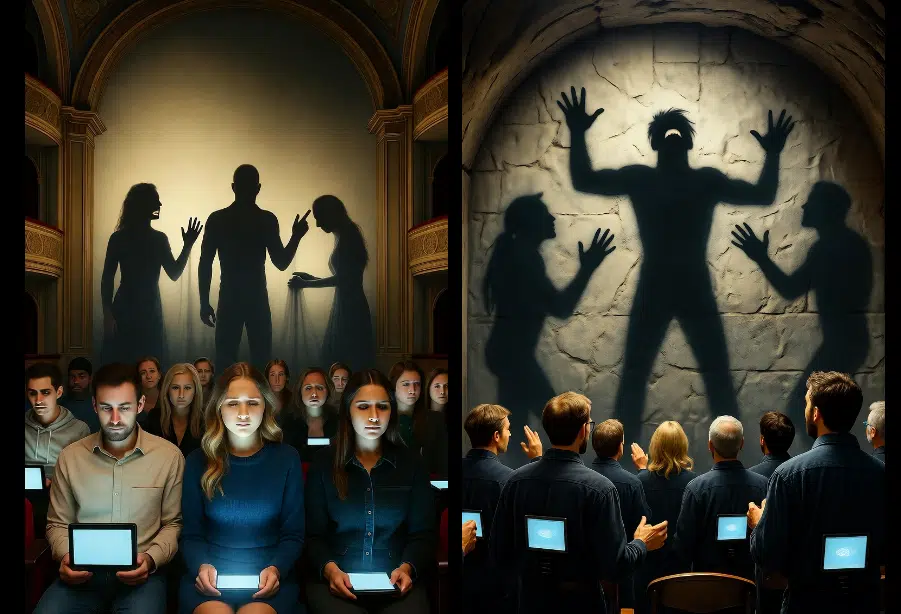

Seemingly everyone in the commentariat has an opinion on what most hadn’t heard or thought of 10 days ago (Silicon Valley Bank), and from there it’s as though everyone has a role to play. And they’re playing it in order to feed their ravenous flocks. The New York Post feeds conservatives, and conservatives want to be told that a focus on ESG, DEI, and other dopey lefty notions brought it down. Which is too bad. It’s too bad simply because ESG and the rest are serious issues that rate serious discussion: do they rob all-important shareholders for distracting businesses from the pursuit of profits, or do they actually reward shareholders for these initiatives existing as a lure for the best and brightest of employees without which businesses can’t prosper? Applied to SVB, might an accenting of ESG issues have proved a lure for lucrative clients, and if so, is SVB to be blamed for this…by conservatives?

The main thing is that present evidence at least for now indicates that SVB’s troubles were born of assets the value of which were compromised in the near-term by rising market rates of interest. In other words, to bruit ESG and the rest is to pursue non sequitur.

What about Democrats convinced the Fed did it? It’s an interesting point-of-view, Elizabeth Warren has asserted as much to a lefty base that reads the New York Times carefully, but it’s interesting in consideration of how the Fed had been raising rates for almost exactly a year when SVB’s troubles became apparent. Markets anticipate, so why if the Fed is so obviously the culprit did SVB only become a story a year after Jerome Powell’s panic began? Better yet, why didn’t more banks go belly-up at the same time that SVB, Signature, and Silvergate did? With the last two, supposedly the troubles for them were rooted in cryto problems as is.

Interesting about banks in a broad sense is that bank stocks fell the most after SVB was saved, which isn’t really surprising. Bailouts presume a freezing in place of the existing commercial order in concert with more regulation of that same commercial sector in the future. Were the bailouts the real cause of subsequent market carnage? Something to think about.

To conservatives who properly favor the market, supposedly the root of SVB’s troubles (and the banks of the future) is “moral hazard.” Andy Kessler contends that the bailouts of SVB and others “creates a classic moral hazard, encouraging bankers to let risk rip—no need for a chief risk officer—and then maximize profits because the federales will step in later. The only thing this guarantees is future bailouts.” Kessler is very wise, and surely knows his way around Silicon Valley, but one guesses he couldn’t name one bank or big-company CEO that has ever “let risk rip” on the assumption that “the federales will step in later.” He likely can’t simply because bailouts hardly bail out the reputations (or wealth) of those who might be prone to throwing caution to the wind on the dime of others. “Moral hazard” is problematic in theory, but difficult to locate in practice.

Lefties, some on the right, and the embodiment of sanctimonious in Thomas Hoenig point to regulatory failure as the cause of a “predictable” crack-up at SVB, but none were predicting SVB’s demise before the markets sleuthed what regulators plainly had not. It’s amazing even the doltish could embrace such a foolish explanation as “regulatory failure.”

All of which leads to a basic question: is it possible SVB simply ran into trouble? Nothing more than that? How quickly we forget just how difficult it is to run a business. This is most evident in a country like the U.S. defined by relentless market dynamism. Figure that the reason CEOs are paid so well in the first place is rooted in just how much money they can make for shareholders. Ok, but the obvious tradeoff to any economy in which enormous sums can be earned is the much higher possibility of not making a lot of money, or worse, failing.

What doesn’t measure up doesn’t last long, which means crucial physical, financial and human capital doesn’t rest in the wrong hands for long. Good. That’s the stuff of progress, andof much better businesses.

Instead of endless whining about business failure, much more perilous is a lack of it. Sadly that seems to be where willdy overwrought liberals and conservatives want to take us in their relentless search for a villain…so that banks will fail less? As the song goes “maybe you’re the problem.”

This article was originally published by RealClearMarkets and made available via RealClearWire.