63% of Small Business Employers Concerned ‘Shaky Economic Environment Could Force Their Business to Close’

A Job Creators Network Foundation monthly survey is providing somber insight into how some small businesses view the U.S. economy.

Sixty-three percent of small business owners “said they’re worried that the shaky economic environment could force their business to close—a six-point jump compared to February,” a press release said.

The March poll, conducted by John McLaughlin and Scott Rasmussen between March 7 and March 30, found that “45 percent of small businesses called inflation their number 1 or number 2 biggest concern” while “client spending and the economy was also high on the list with 29 percent calling it a top concern.”

“Despite flowery rhetoric from the Biden administration, it’s clear small business owners don’t think the economy is all sunshine and rainbows,” Elaine Parker, president of the Job Creators Network Foundation, said in the press release. “Concern around inflation remains high, 61 percent feel that complying with government regulations is a time suck, and more than half of respondents say policies pushed by the White House have been a net negative for Mainstreet.”

“Rather than doubling down on a policy blueprint that has failed to deliver, lawmakers need to reset the agenda to focus on empowering the backbone of the U.S. economy: small businesses,” Parker said.

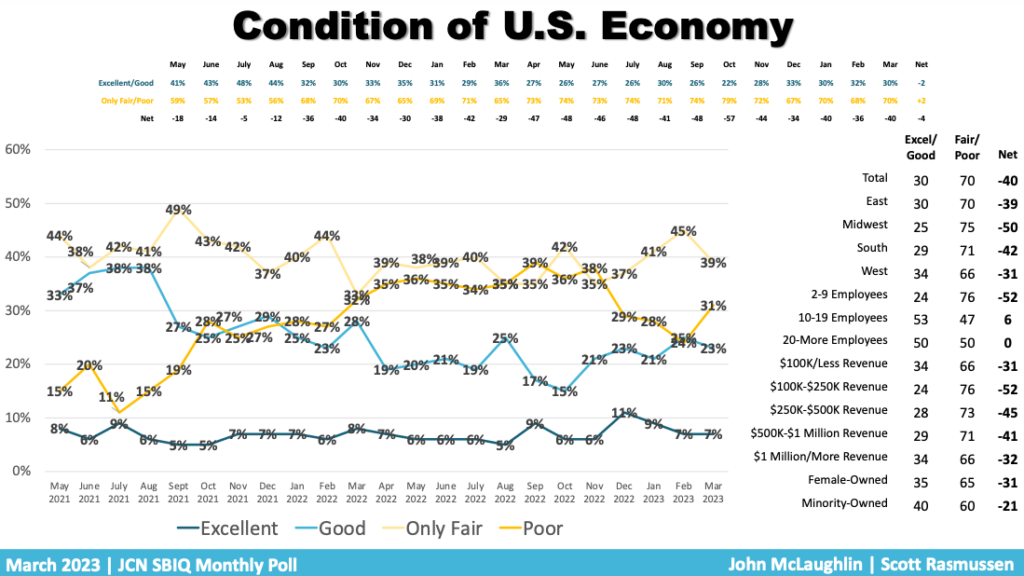

Thirty percent of the survey’s respondents said the U.S. economy was in “excellent/good” condition compared to 70% of respondents who said the U.S. economy was in “only fair/poor” condition.

The survey’s respondents, which included 400 small business employers, were overwhelming against taxpayers paying off $400 billion in student loan debt. Sixty-four percent said “no,” 19% said “yes,” and 17% said “unsure.”

The survey’s respondents also overwhelmingly—85%—favor “balancing the federal budget to rein-in spending and reduce inflation” while 86% support “making it easier for small businesses to raise capital, like get a loan or a line of credit.”

“The Small Business Intelligence Quotient, an index tracking overall small business sentiment about the economy, declined by 1.6 points to 54.6—marking the lowest reading of 2023 thus far,” the press release said.

Twenty-four percent of the respondents said the U.S. economy’s direction was “better” compared to 20% who said it was the “same,” and 56% who said it was “worse.”

The consumer price index, a key measure of inflation, was released on Wednesday morning and showed inflation rose 0.1% in March and 5% since March 2022, the U.S. Bureau of Labor Statistics reported.

“Today’s inflation data show prices rising more than twice as fast as the Fed’s target 2.0% rate,” EJ Antoni, a research fellow for regional economics in the Center for Data Analysis at The Heritage Foundation, told The Daily Signal after the report’s release. “Inflation is far from dead, despite the White House [likely] taking a victory lap on today’s numbers. It’s ironic that they are taking credit for reducing inflation after causing it in the first place.”

Alfredo Ortiz, president and chief executive officer of the Job Creators Network, also weighed in on Wednesday’s consumer price index report.

“Today’s CPI report marks the two-year anniversary of declining real wages for ordinary American workers as a result of ongoing historic inflation,” Ortiz said in a statement. “This sad anniversary is the result of President [Joe] Biden and Congressional Democrats’ reckless spending that has diluted the value of the currency already in existence.”

“The two-year decline in living standards for ordinary Americans proves once and for all that Democrats are America’s anti-worker party,” Ortiz said. “Their easy fiscal and monetary policy, known as Modern Monetary Theory, has been wholly discredited by this prolonged erosion of the dollar’s value.”