May 1st Is “May Day” Biden Celebrates by Penalizing Those With Higher Credit Scores

Have you worked hard to keep your finances in shape? Do you budget yourself, spend less than you make? Have you kept a keen eye on your credit, making sure that you keep your score moving up?

Joe Biden doesn’t care. No wait, actually he does. Now he can use your hard work, to take more of your money. Yep, and you won’t have to wait long for sleepy Joe to pick your pocket either. His new boondoggle, that shows total disrespect for hard working Americans, takes effect on May 1st.

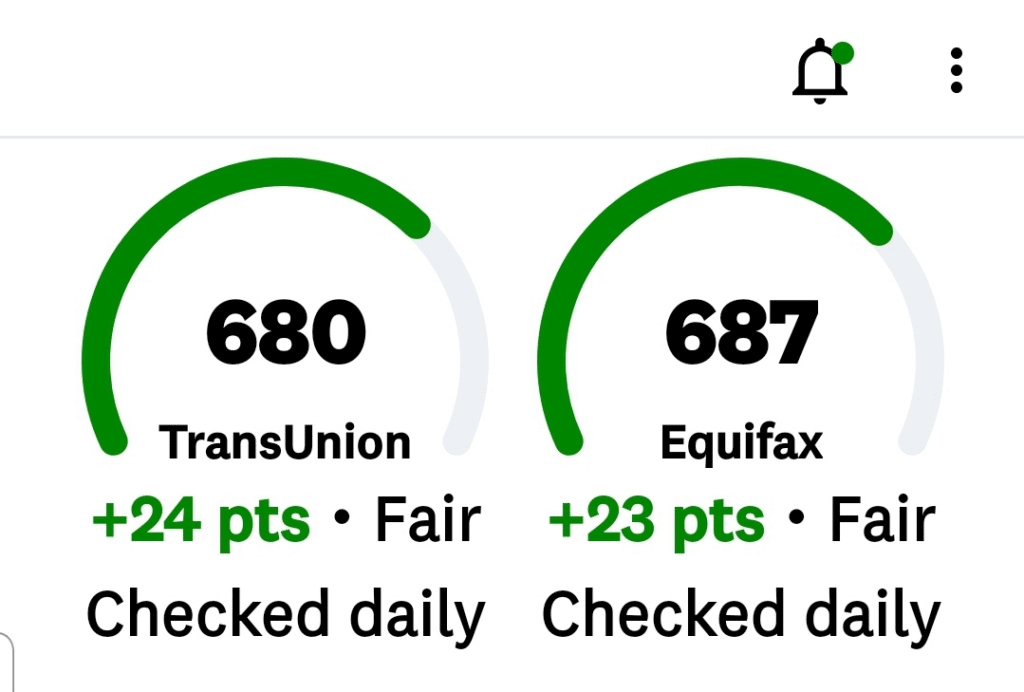

The good old days, when credit score logic mattered, is just nine days away. Why? Well, because starting on May 1st, if your credit score is around 680 or above and you buy a house it’s going to cost you. According to experts, You would pay about $40 more per month on a $400,000 mortgage. The Federal Housing Finance Agency says that your monthly donation will help subsidize people that have lower credit card ratings who are also looking for a mortgage.

David Stevens was the commissioner of the Federal Housing Administration under Barack Obama. He understands that the Federal Housing Finance Agency is trying to give consumers more affordable housing choices, but he disagrees with this way of doing it. He posted this on social media:

“This confusing approach won’t work and more importantly, couldn’t come at a worse time for an industry struggling to get back on its feet after these past 12 months. To do this at the onset of the spring market is almost offensive to the market, consumers, and lenders.”

Sandra Thompson, who is the director of Federal Housing Finance Agency, defended the new rules stating that they are designed to, “increase pricing support for purchase borrowers limited by income or by wealth and comes with minimal fee changes.”

Steven’s, while agreeing that there is a gap in opportunities for low-income borrowers, doesn’t agree that price manipulation is a sound solution.

“Why was this done? The answer is simple, it was to try to narrow the gap in access to credit, especially for minority home buyers who often have lower down payments and lower credit scores. The gap in homeownership opportunity is real. America is facing a severe shortage of affordable homes for sale combined with excessive demand causing an imbalance. But convoluting pricing and credit is not the way to solve this problem.”

None of this makes any sense. Interest rates have been steadily rising, and according to experts will continue to do so. Only Biden’s administration could see this as a good time to penalize borrowers that have good credit scores and more money for a down payment. Let’s face it, is there ever a good time to penalize any American for doing a good job with their finances?

The far left wants socialism. They look down their noses at the American people, viewing them as chess pieces. In their minds, the way to make two people the same height isn’t to give the shorter person a chair, it’s to cut off the legs of the taller one.