A Nation’s Addiction to Cheap Debt

With the recent collapse of the regional bank PacWest, Americans are growing increasingly worried about the health of the banking system. In fact, a recent Gallup poll found that nearly half of Americans are worried “about their money’s safety in banks”–even more so for Republicans and Independents.

Of course, the heads of the American Regime claim everything is all right. President Joe Biden gave a recent press press conference after PacWest’s collapse and vowed that regulator’s actions would keep the US banking system “safe and sound”. Likewise, Federal Reserve Chair Jerome Powell claimed that U.S. banking system “looks sound and resilient.”

So, something is not right here. Are the American people worried about nothing or is the American regime lying to us once again? Considering how the Regime has lied about the origin of the COVID-19 pandemic, the Border crisis, and the 2020 BLM riots in recent years–I think that the American people are rightly worried about the state of the US economy and banking system.

So then, how did we get here? Why have three fairly large banks collapsed in the past few months?

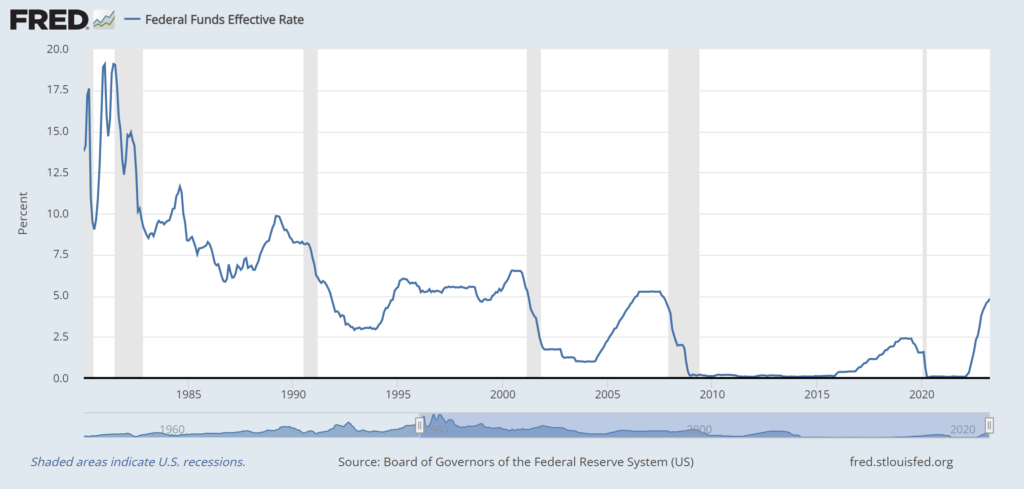

The short answer: America’s addiction to cheap debt. The following graph from the Federal Reserve St Louis website highlights America’s addiction to cheap debt.

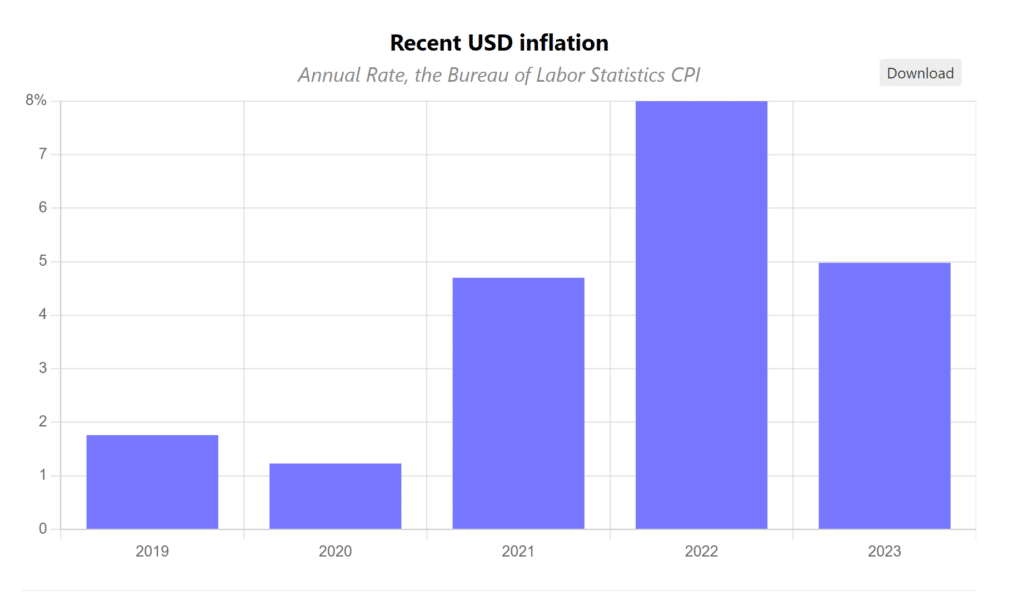

Since the 2008 Great Recession, the Federal Reserve (i.e. US National Bank) has set the interest rates at nearly 0% (except for a brief period from 2018 to 2019) for the past fifteen years. However, the Federal Reserve started increasing interest rates again in 2022 and 2023 due to combat the extremely high rates of inflation in 2021 and 2022. For background, higher interest rates are a tool the Federal Reserves uses to slow down economic activity and decrease inflation.

Long story short, the US economy was “high on the hog” on fifteen years of artificially low interest rates. Many American individuals and large businesses lived off cheap debt and grew their businesses by acquiring debt financing.

The problem now in 2023 is that interest rates have increased drastically. Therefore, companies have to pay much higher interest rates for the same debt that cost almost nothing a few years ago.

The high interest rates in 2023 played a role in the collapse of Silicon Valley Bank and Signature Bank back in March 2023, and scores of major corporations have announced layoffs–in the wake of the incoming recession and rising interest rates. The outcome for the economy is not looking rosy on the horizon.

Overall, the American economy and banking system is not standing on solid ground–from the $30+ Trillion national debt to a declining manufacturing base and high inflation to young Americans struggling to afford housing.

America needs and deserves leaders who will establish fiscal responsibility policies at all levels of society–from the Federal government to local government. Future generations will pay the consequences of decades of poor economic decades decisions by the American regime. In the meantime, America First patriots need to personally put their personal finances in a stable position–especially with a potential recession toward the end of 2023/early 2024.

“Kicking the can down the road” won’t suffice anymore. America’s addiction to cheap debt is sowing the seeds for further economic pain down the road.