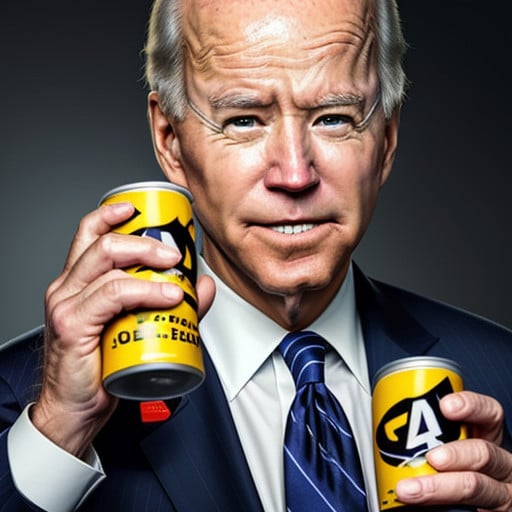

Beware of Biden’s Amped Up Energy Drink Economy

Anyone who ever knocked back a Red Bull has experienced the exuberant spike in energy the drink provides as caffeine floods the circulatory system, and sugar and fructose cause a spike in insulin levels. For a brief period, an energy drink can clear brain fog, heighten awareness and increase productivity.

Unfortunately, within a couple hours, the amped up levels of caffeine decline, and once the sugar is used up, insulin levels plummet, and focus and clarity are replaced by lethargy and fatigue. At that point, there are only two choices: suffer through the crash, or slug down another Red Bull.

Which brings us to the U.S. economy.

For the better part of 2023, analysts were generally in agreement that the U.S. would sink into a recession sometime in the latter half of the year. Runaway inflation in 2022 forced the Fed into an interest rate tightening cycle, which almost always ends in a recession, since higher rates choke off business expansion and consumer spending.

The signals were all there, confirmed by an inversion of the yield curve. However, as the year progressed, it became increasingly clear that the U.S. had avoided a recession, and the Fed had achieved the rare “soft landing.”

This was evidenced by strong jobs reports that continued into 2024. In January, the economy added 335,000 jobs, well ahead of the 225,000 consensus. Equally impressive was the gain in hourly wages, which increased .6% on a monthly basis and 4.5% in the past 12 months, easily outpacing the current annual inflation rate of 3.4%.

Good News Joe Takes Credit

All of this good news has Biden’s handlers doing cartwheels in the White House. While Slow Joe remains wildly unpopular, ostensibly, his economic policies seem to be working, right?

When the most recent jobs report was released, Biden was quick to take full credit. “Put simply, I would argue that the Biden economic plan is working,” he said in remarks last Friday. “These critics and cynics are wrong.”

Coupled with the reduction in gas prices from a high of $5.10 per gallon in 2022 to $3.14 per gallon most recently, and cooling inflation that dropped from 9.2% in 2022 to 3.4% in January, one might imagine Biden deserves praise for creating a thriving economy.

So, why are his latest job approval numbers the second lowest of any president at this point in his term?

In fact, Biden’s approval rating stands at 39.8%, which is second only to failed president Jimmy Carter, who stood at 37.4% after his third year in office. On the surface, the ratings make sense. Both Carter and Biden stand as perhaps the two most incompetent presidents in history, but there are notable differences.

Carter was dealing with the worst economic calamity of modern times, even if it was largely of his own creation. In December 1979, inflation was 13.9%, unemployment stood at 6.3%. So, what gives? Why is Biden in Carter’s approval rating black hole when everything in the current economy is looking rosy?

The Red Bull Economy

While the fiasco at the border, countless wars and radical cultural policies drag Biden down, at the end of the day, people still vote with their wallets, and Biden’s low approval rating means voters aren’t buying into the numbers.

Like a house that presents well but has a crumbling foundation, the American people either realize or sense that the Biden economy is a house of cards that could collapse at any moment. They understand you can only chain-drink Red Bulls for so long, and the more of them you drink to avoid the crash, the worse the crash will be when it inevitably happens.

Biden’s handlers have kept all the plates spinning by ensuring enough borrowed money is injected into the banking system to keep the economy juiced. That’s the caffeine part. In fiscal 2019, the year before the pandemic, the federal government spent $4.4 trillion. However, during the pandemic, spending ballooned to $6.5 trillion. This included the introduction of massive free money giveaway programs to individuals and corporations. Free rent and suspension of student loan payments were just more icing on the cake.

The understanding by both Republicans and Democrats was that once the pandemic subsided, spending would return to pre-pandemic levels, but you can guess what happened with woke leftists in charge. Instead of focusing on fiscal responsibility, Democrats simply used the pandemic as an excuse to establish a new spending floor, and as a result, they added $6 trillion in new money to the economy over three years.

To put that into perspective, the total Gross Domestic Product (GDP) for 2023 was $27.3 trillion. That means the increase of $2 trillion in unanticipated spending in 2023 represents 7.1% of GDP.

That’s a staggering number, so it’s no surprise that injecting $6 trillion into the system during the Biden presidency had enormous consequences for growth. As the money filtered through the economy, it created a massive imbalance on the demand side, and the supply side still hasn’t fully caught up.

By 2023, most of the free money programs were wrapping up, but many Americans were addicted to their elevated spending, and they turned to credit to maintain their artificially elevated lifestyle. In fact, credit card debt skyrocketed in 2022 after the giveaways ended, and credit card utilization (the percentage of total available credit in use) reached 28% in 2023, an all-time high.

That’s the sugar part of the energy drink blast.

The Inevitable Crash

Reckless spending has put the Federal Reserve between a rock and a hard place. On the one hand, the $2 trillion in additional unexpected spending is like adding nitrous to a high-performance engine, and as long as the government spends at such irresponsible levels, demand will remain relatively high, which means it’s difficult to slow the economy. Certain segments like home and auto sales suffer disproportionately because they bear the brunt of artificially high interest rates. That’s part of the reason why young married couples can’t afford to buy a house.

Conversely, the higher rates force the government to pay more in annual interest on the national debt, which has ballooned from $22 trillion before the pandemic to $34 trillion in 2023 on Biden’s watch. The interest on the debt is now approaching $1 trillion annually and is the fourth largest federal budget expenditure. Worse, every year, the accumulated interest is combined with the additional debt created through irresponsible spending.

The day of reckoning is near because a nation consumed by debt will eventually collapse. The U.S. is nearing an inflection point where it either reigns in spending, or it will face a sovereign debt crisis.

As if the deficit issue isn’t bad enough, Americans are running out of credit to leverage their purchases. In fact, since the free money programs expired in 2022, credit card delinquency rates have risen from 7.59% to 9.74%. Overall consumer debt has risen from $16.3 trillion in 2022 to $17 trillion in 2023.

The government, businesses and the consumer are swimming in red ink, and making those loan payments is becoming increasingly difficult. At some point in the near future, the economy is going to experience the fatigue, burnout and exhaustion that comes with the economic equivalent of an energy drink overload.

For his part, Biden will keep pouring the Red Bulls into the system throughout 2024 because his handlers know any downturn in the economy will spell certain doom for his reelection efforts. Even after the election, it’s probably safe to say leftist Democrats won’t do anything to save America’s financial future. The only ray of hope is that despite appearances, poll numbers reflect the suspicions of many Americans that something is very wrong with our country’s fiscal policy.

Let’s just hope that Donald Trump wins in November, and that’s the last Red Bull the American economy consumes for quite a while.