The Impending American Credit Catastrophe

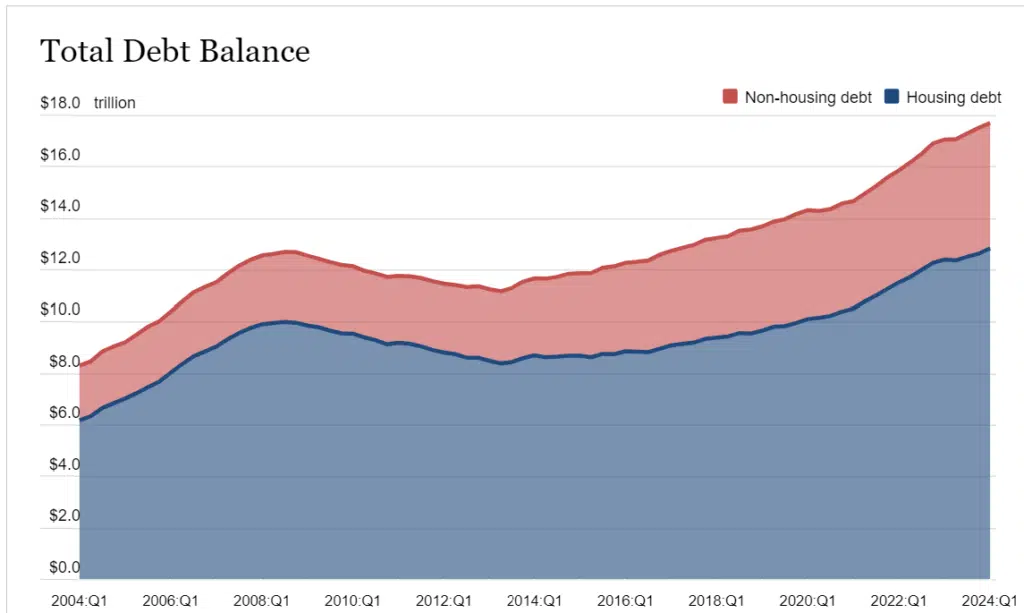

In 2023, American citizens collectively racked up an insane amount of credit card debt. According to the Federal Reserve Bank of New York, the total credit card balance of the American population exceeded the $1 Trillion threshold in Q4 2023.

In addition to this record-level credit debt, Americans are becoming delinquent on their credit card payments. Back in January, Bloomberg reported that credit card delinquency rates climbed to the highest rate in a decade.

Overall, mortgage balances, auto loan debt, and personal credit card debt are rising at a rapid rate.

I personally believe that these rising debt totals are response to the high levels of inflation in the American economy over the past three years. The irresponsible monetary policy coming from the Federal Reserve and the huge deficits ran by the US Federal government have led to persistently high inflation in the last three years. Therefore, people are using debt to keep up with inflation since average income levels are not rising enough to keep up with inflation.

The graph below came from the New York Federal Reserve website regarding the Americans’ debt balance:

Obviously, we’re seeing a ticking personal debt crisis on the horizon. However, business media and politicians still claim that the American economy is strong—despite more Americans struggling with debt in recent years.

High inflation rates, high interest rates, and high debt balances are a terrible trio that we are witnessing under the Biden economy. At this point, a change in presidential administrations seems like the only way to get out of the current economic mess that we are in.

Politics and elections have consequences, and the current economic climate we’re enduring is the result of poor fiscal, monetary, and economic policies over the past several years.