What if the petrodollar disappears?

I hope you have a disaster preparedness plan—and nuclear war is not the only possible sudden apocalypse.

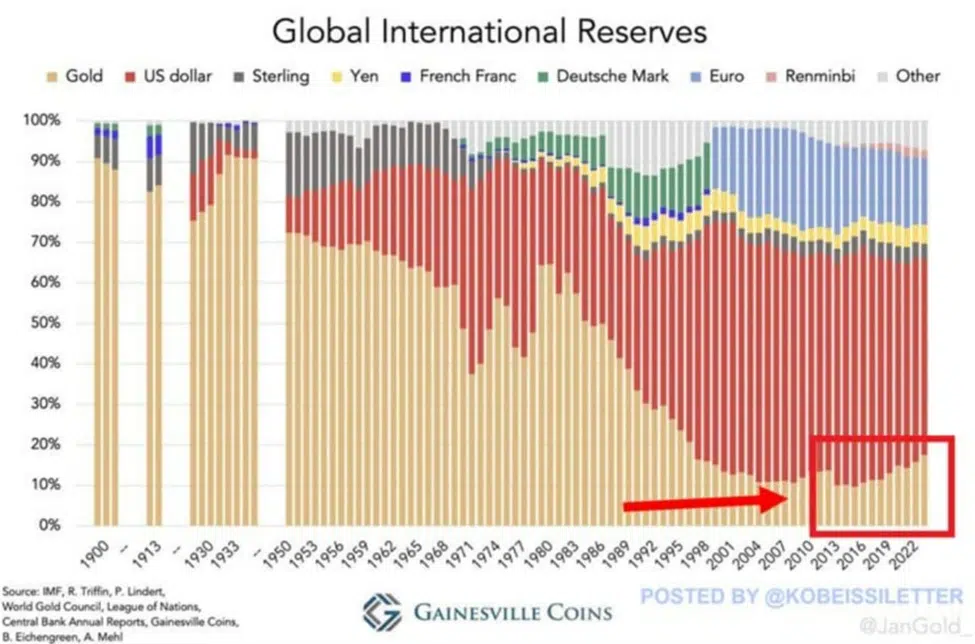

America’s economic predominance depends on the value of the dollar, which is the international reserve currency. As the graph shows (see red box), the percentage of international reserves held in dollars is slowly decreasing, and the percentage held in gold is increasing. What could greatly accelerate that trend?

June 9, 2024, could be the Day of the Black Swan, as Saudi Arabia is said by some to have declined to renew a 50-year petrodollar agreement, which requires the Saudis to price oil in dollars in exchange for U.S. military protection. This has, however, been called “fake news.” Does such an agreement exist? If so, what does it say? Does it have an expiration date?

With or without a written agreement, the Saudis have been getting paid in dollars. As David Stockman points out, the petrodollar “creates a tremendous amount of demand for the U.S. dollar all over the globe. Since everyone has needed it to trade with one another, that has created an endless global appetite for the currency. That has kept the value of the dollar artificially high, and it has enabled us to import trillions of dollars of super cheap products from other countries.” It also creates demand for U.S. Treasuries.

The position of the dollar gives Americans an “exorbitant privilege,” say foreign critics.

David Kurten, former candidate for London mayor, considers the end of the petrodollar to be the beginning of a “new era” with great geopolitical changes.

Talks between the Saudis and the Chinese over yuan-priced oil contracts have been going on for years.

As the U.S. has shipped a huge part of its productive capacity overseas, dollars are the most important thing it has to offer, aside from weapons. The dollar has been trusted. But with the U.S. owing $35 trillion in acknowledged debt, which might be “monetized” by inflation, uncertainty is building. Foreigners may also worry that if the U.S. sanctions their government, their investments might be seized. Some $300 billion in assets owned by Russians were frozen, and now may be seized and given to Ukraine.

Think about the implications of a devalued dollar for your family, and evaluate how much of your net worth is in dollar-denominated assets. What can you do to increase your ability to survive in tough times?

Additional information:

· Russia is officially the world’s fourth largest economy, with low debt and high self-sufficiency.

· Financial distress hitting the middle class

· Nuclear War Survival Skills: advice on food, sanitation, medical supplies, and much more for any type of calamity