Persistent Inflation continues heading into 2025

Inflation has been a hot topic in the American economy over the past four years. As we all know, the Federal Reserve drastically increased the money supply in 2020 and 2021, and the Federal Government rapidly elevated its spending levels during the Biden administration. In fact, federal spending increased by roughly 40% between 2019 and 2023—according to the Congressional Budget office.

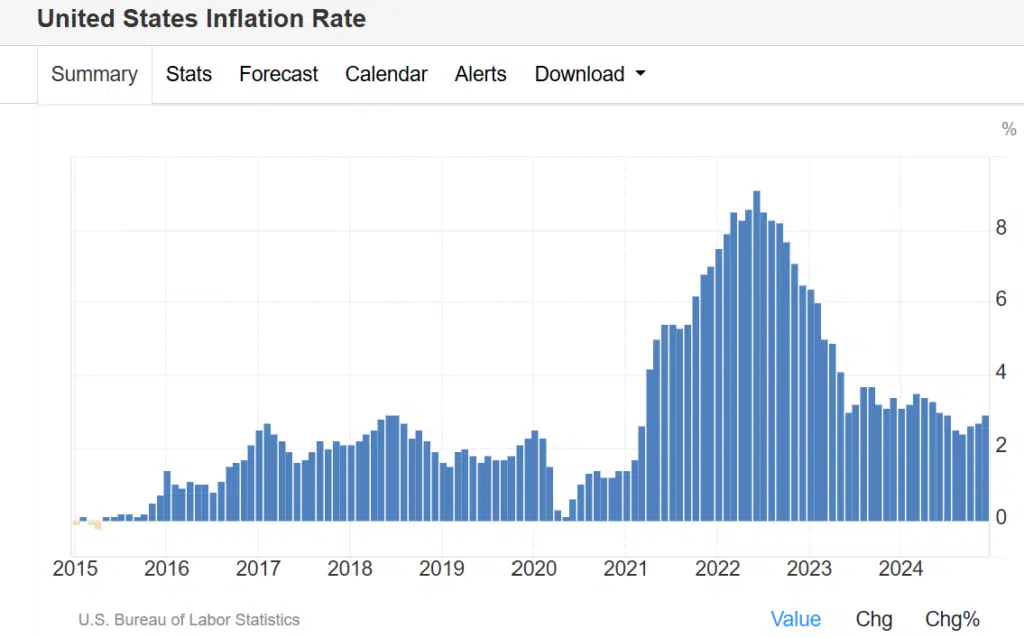

Well, all actions have consequences, The disastrous monetary and fiscal policies of the early 2020s led to rampant inflation over the past three years. Before the 2020s, the United States economy had experienced relatively low levels of inflation over the past 25 years.

But then in 2021, everything changed. Inflation started skyrocketing in early 2021. According to the Consumer Price Index (CPI), year-over-year inflation peaked at over 7% in the summer of 2021.

Although the rate of inflation has decreased since its recent peak in 2021, inflation still has remained high in the United States. In fact, the year-over-year rate of inflation has not fallen below 2.4% in any month since early 2021. That fact means the average American family has seen drastic decreases in their purchasing power over the past three years. Based on the CPI, a single dollar in December 2024 buys as much as $0.83 in January 2021

Sadly, most Americans’ wages have not kept with the rate of inflation over the past three years. Therefore, consumers have largely turned to debt in order to maintain their current standards of living. According to Lendingtree, the American population possesses a total of $1.16 Billion in credit card debt as of late 2024–up from only roughly $770 billion in early 2021.

Unfortunately, the economic outlook is not looking much brighter for the American people. Last month, inflation moved up to an annual rate of 2.9% in December. With the Federal Reserve expected to make more interest rate cuts in 2025, many economic analysts do not believe that inflation will get below the desired annual 2% target rate anytime soon.

Heading into this year, persistently high inflation will remain one of the defining features of the previous Biden administration and one of the top economic priorities of the incoming Trump administration. Only time will tell how the next Trump administration handles this major economic issue.