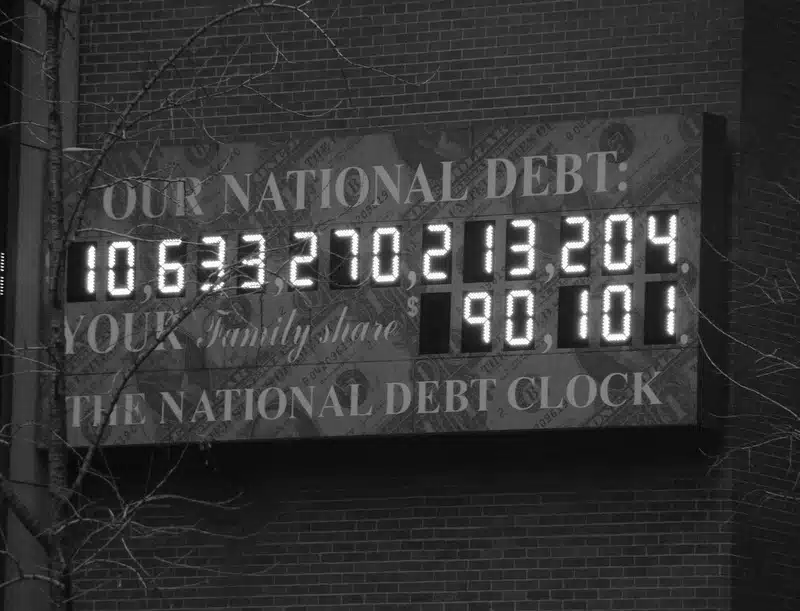

Debt Levels Have Accelerated To ‘Unsustainable’ Levels, GAO Warns

Unless spending and revenue policies change, America’s debt will continue to grow faster than the economy—even during times of growth.

This is according to a 26-page report that the U.S. Government Accountability Office (GAO) published last week.

This is something that the GAO calls “unsustainable.”

“In fiscal year (FY) 2024, the government spent over $1.8 trillion more than it took in, marking the fifth year in a row with a deficit above $1 trillion,” according to the report.

RELATED: CBO’s Latest Federal Budget Outlook is, Predictably, Gloomy

“This gap will continue to grow as revenue is not expected to cover growing spending for mandatory programs like Social Security and Medicare. The government will have to keep borrowing to finance budget deficits each year.”

The federal government, of course, must pay interest on its debt.

In FY 2024, the government spent $882 billion on net interest—more than was spent on national defense or Medicare. Annual spending on net interest has more than tripled since FY 2017, when it was $263 billion.

“We estimate spending on interest will be more than $1 trillion in FY 2025,” GAO officials wrote.

“The growing debt and interest costs pose serious economic, security, and social challenges to the U.S.”

According to the report:

• For most of the nation’s history, debt held by the public relative to GDP [Gross Domestic Product] increased during wartime and recessions but then decreased during peacetime and periods of economic growth. More recently, according to the report, this pattern has changed, as the debt has grown even during times of economic growth.

• Debt held by the public will reach its historical high of 106 percent of GDP by 2027 (one year earlier than GAO officials projected last year).

• Debt held by the public grows more than twice as fast as the economy over a 30-year period and reaches 200 percent of GDP by 2047 (three years earlier than GAO officials projected last year).

RELATED: The 118th Congress Must Tighten Spending the Most in These Areas

Higher interest rates for the government mean higher interest rates for individuals, households, and businesses. This adversely impacts the lives of Americans who may experience higher borrowing costs, stagnant wages, and more expensive goods and services.

Special thanks to Warhammer’s Wife for proofreading this story before publication to make certain there were no misspellings, grammatical errors or other embarrassing mistakes and/or typos. Follow Warhammer on Twitter @Real_Warhammer or on Facebook.