U.S. Tariffs Are Crushing China’s Economy

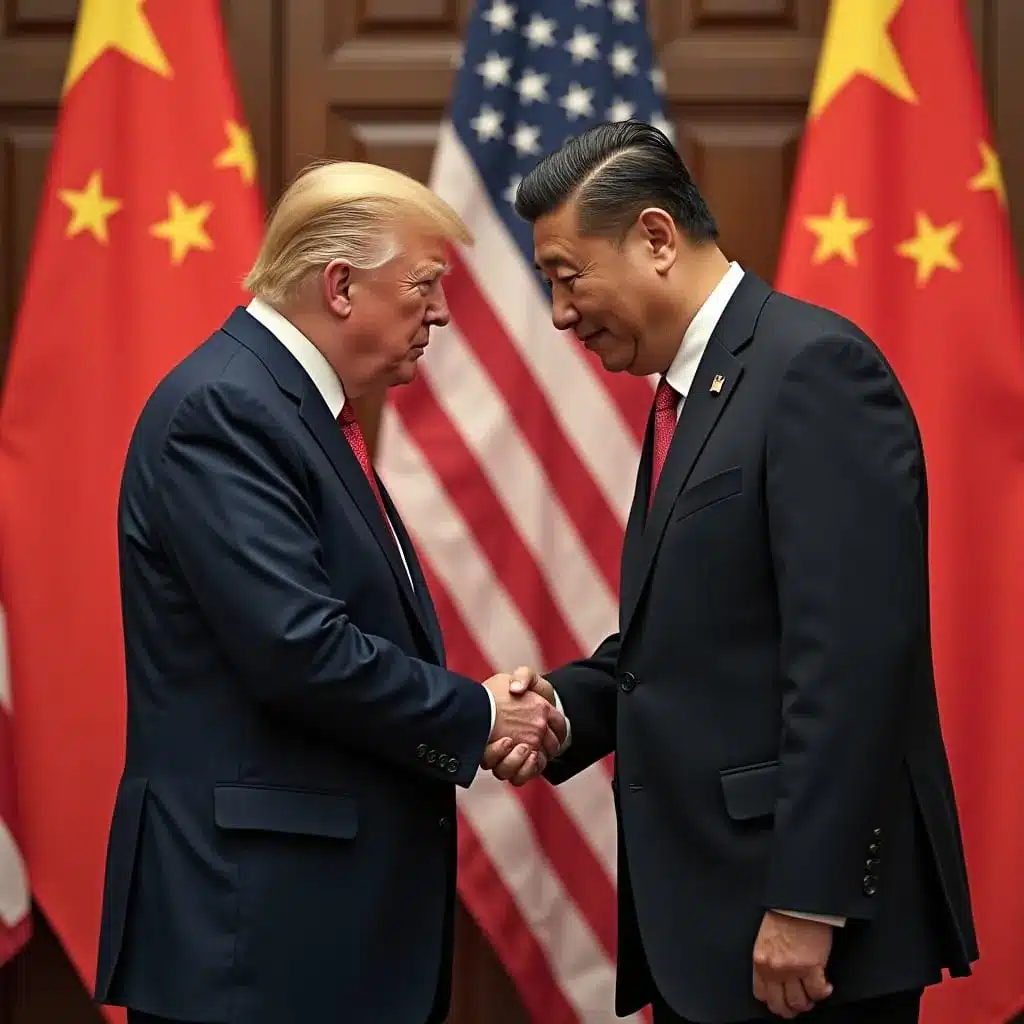

Treasury Secretary Scott Bissent recently revealed that China was going to crash the trade talks he had scheduled with Swiss officials this week. Make no mistake about what this means: China is serious and desperate. They are sending He Lifeng, China’s chief trade czar and a close confidant to Xi Jinping.

So, why the sudden urgency? Isn’t this the same China that vowed to “fight to the end” on trade just a month ago?

In early 2025, the United States significantly escalated its trade measures against China, culminating in a 145% tariff slapped on Chinese goods on April 9th. These actions have intensified economic challenges for China, affecting exports, manufacturing, and broader economic stability. The cumulative effect is starting to break China’s will, and we’re still in the early innings.

Escalation of Tariffs in 2025

On February 1, 2025, President Trump signed an Executive Order that imposed a 10% tariff on all Chinese imports, effective February 4th. This move was part of a broader strategy to address national security concerns and trade imbalances. Subsequent increases followed: a rise to 20% on March 4 and a final escalation to 145% on April 9th. These tariffs encompassed a wide range of goods, including electric vehicles, solar cells, steel, aluminum, and critical minerals.

Impact on China’s Export and Manufacturing Sectors

The heightened tariffs have exacerbated challenges for China’s export-driven economy. The increased costs have made Chinese goods far less competitive in the U.S. market, leading to a decline in exports. This downturn has significantly affected China’s manufacturing sector, with many factories experiencing reduced orders and production slowdowns. Reuters reports that these challenges have prompted China to implement monetary stimulus measures, including interest rate cuts, reduced bank reserve requirements, and a scheme to allow insurance companies to invest directly in businesses affected by the tariffs.

Severe Structural Vulnerabilities and Debt Concerns Exposed

Beyond the immediate effects of the tariffs, China’s economy faces structural challenges that expose its vulnerabilities. The real estate sector, once a significant driver of growth, has been in a prolonged downturn since 2021. Landlords can’t collect rent, and bankers can’t collect mortgage payments. This decline has led to reduced local government revenues, which heavily relied on land sales for funding. Additionally, the property sector’s struggles have contributed to unsustainable debt levels among local governments. The International Monetary Fund (IMF) estimates that total government sector debt reached 147 trillion yuan ($20.7 trillion) by the end of 2023.

This is a potentially catastrophic development for a country already on the ropes.

Futile Trade Diversification and Global Positioning Efforts

In a desperate effort to mitigate the impact of U.S. tariffs, China sought to diversify its trade partnerships. The country reduced tariffs on imports from other nations and actively pursued participation in major trade agreements such as the Regional Comprehensive Economic Partnership (RCEP) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). These moves aim to strengthen China’s position in global trade networks and reduce reliance on the U.S. market.

Unfortunately for China, none of that seems to be working. You see, it’s not easy to replace a half trillion dollars of high margin business by cobbling together a roster of nations who can’t pay their bills. In essence, if you want to do business and get paid, your choices are the U.S., Europe and a few other industrialized countries. Despite their increasingly leftist slant, it appears Europe is not quite ready to embrace Chairman Mao’s style of government, which means China’s realistic options are limited.

Protests in China

The containers are piling up in Shanghai, and workers, who haven’t been paid, are protesting. These are remarkable events considering that a protestor in China could find themselves dumped in a work gulag for 10 years or worse. Go talk about due process in China and see where that gets you.

This trade war is a growing crisis that China cannot win, and the sooner they recognize their diminished position and capitulate to President Trump, the better for all parties involved. As much as we may despise China and its hegemonistic, authoritarian government, an economic collapse would plunge the world into a severe global recession.

Hopefully, the first step towards a resolution begins this week in Switzerland. After all, it’s important to remember the U.S. has a lot of woke leftists who are really pissed off that the cheap junk from China they’re addicted to might become unaffordable.