Trump Can and Should Fire Fed Boss Over Economy

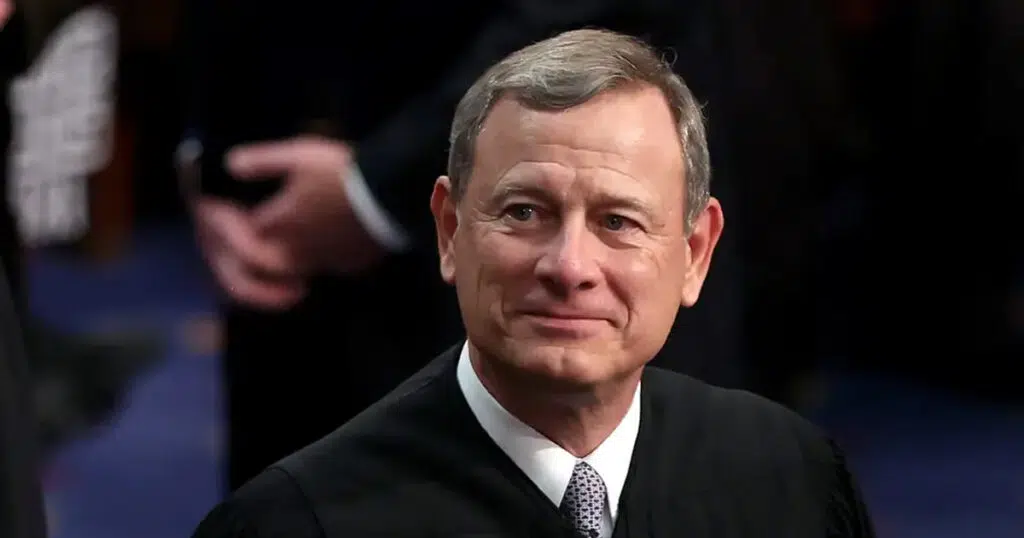

Federal Reserve kingpin Jerome Powell is busy doing what he does best: sabotaging a prosperous economy so that President Donald Trump and his fellow Republicans lose popularity. He’s also ignoring Trump, whom voters will judge for the economy’s performance and whom the Constitution says runs the executive branch of which the Fed is a part.

This is old hat for Powell, who, after being installed by Trump in 2018, got straight to work undermining his boss’s economic recovery.

You may recall that one of the circumstances that brought an unusual candidate like Trump to power in 2016 was the preceding decade of economic malaise. The Obama years averaged just 2.1% annual growth – the most lethargic economic recovery since World War II. It was fashionable among establishment economists to say that growth above this level, especially the 4.3% average annual growth of the Reagan boom, was simply unobtainable. Big-government economists – practically a redundant phrase today – called it “secular stagnation.”

Enter Trump. Upon taking office, he immediately began deregulating the U.S. economy, particularly in the energy sector. He worked with Congress to lower the corporate tax rate from 35%, which was nearly the highest among advanced economies, to a more competitive 21%. He also cut personal income taxes for every income bracket, which meant lower taxes for the majority of small business owners who pull company income and taxes onto their personal tax returns.

Trump also incentivized corporations to bring home capital they held overseas. Apple alone said it would bring home a majority of its roughly $252 billion in offshore reserves, paying a one-time tax of $38 billion.

The results for the broader economy were impressive. Annualized GDP growth in the quarter Trump took office was 2.0%. By the end of the year, it had jumped to 4.6%. Unemployment dropped from 4.7% to 4.0%. Manufacturing jobs, which totaled nearly 17 million when NAFTA was enacted in 1994 and globalization ensued, had fallen to 12.3 million when Trump took office. Within a year, the sector saw modest improvement to 12.5 million jobs. Oil production increased from 8.9 million to 10 million barrels per day during that year. (It would reach 13 million later in Trump’s first term.)

But Powell was having none of it. Like most of his predecessors and colleagues at the Federal Reserve, Powell adheres to the discredited Keynesian school of economics, which holds that the government should play a preponderant role in the economy, managing demand through government spending. Keynesians distrust free markets, free people, and the supply side of the economy that produces tangible goods. They believe economic growth leads inevitably to inflation, despite repeated economic expansions, including most notably Reagan’s, in which the expansion of the private-sector economy leads to more goods and services produced and stable prices.

In 2018, Powell saw looming inflation where there was none and tightened monetary policy for the first time since 2008. When Trump was elected in 2016, the federal funds effective rate stood at 0.41%. Despite no inflation, the Fed began a relentless cycle of rate increases that reached 2.2% in time for the 2018 midterm elections, when Republicans lost control of the House of Representatives to Democrats, leading eventually to Trump’s impeachment.

Beyond being a Keynesian, Powell is also a fool. Trump’s first term isn’t the only time he saw inflation where there was none, or failed to see inflation when it was obvious. During the Biden administration, long after the pandemic had peaked, Powell enabled continued federal spending at crisis levels despite the lack of a crisis. Biden’s Treasury Department issued bonds to pay for unprecedented deficits in excess of $1.5 trillion. This only worked because Powell had the Fed buy the bonds with dollars created out of thin air. He also tried to goose the Biden economy by buying mortgages from banks immediately after they were issued. The Fed’s balance sheet of debt it owned grew from $7.4 trillion when Biden took office to a peak of $10 trillion just over a year later. Powell also kept interest rates near zero even as inflation caused by his dilution of the dollar skyrocketed.

Inflation peaked at over 9% in 2022, and the cumulative inflation of the Biden years and Powell’s debasement of the currency eliminated more than 20% of Americans’ purchasing power. Powell and his establishment friends had assured Americans that inflation was “transient” when it wasn’t.

Powell was eventually forced to acknowledge inflation and reluctantly began hiking interest rates to above 5%. He then started lowering them just before the 2024 election in an effort to help Democrats keep the White House. But the easing stopped when Trump took office. Even as central banks in Europe have cut rates due to the lack of inflation, Powell and his clique at the Fed have refused to do so, keeping them at sustained heights not seen in 20 years.

Trump has repeatedly pressured Powell to lower rates. He did so again on June 6 when the government reported that job growth had moderated and revised downward the job growth reported in previous months.

If a Republican president pressuring Powell could work, it would have worked by now. Instead, Trump will have to fire Powell and replace him with a pro-private-sector-growth banker who takes guidance from the president.

Powell and many establishment pooh-bahs think such a move would be illegal. After Trump’s reelection, Powell vowed not to resign and said his termination is “not permitted under the law.” In fact, the Federal Reserve Act does allow Powell’s removal “for cause,” and grotesque incompetence and political conniving ought both to qualify.

But in fact, the whole idea of an “independent” Federal Reserve is unconstitutional, and Trump should fire Powell not only to save the economic recovery but to restore the power of the presidency and recognize the reality that the American people hold the president responsible for economic performance. If he is on the hook to perform, he must control the tools to do so.

Article II of the Constitution states plainly, “The executive Power shall be vested in a President of the United States of America.” In the Federalist Papers #70, Alexander Hamilton explained the necessity of the strong executive created by the then-draft Constitution to skeptics: “A feeble Executive implies a feeble execution of the government. A feeble execution is but another phrase for a bad execution; and a government ill executed, whatever it may be in theory, must be, in practice, a bad government.” It’s as though Hamilton could foresee Powell and the Fed of 2025.

There should be no doubt that the Framers of the Constitution intended the president to have the power to fire anyone as part of his responsibility to supervise the unitary executive branch. What was true in 1789 is still true today: any schmuck in Washington knows no bureaucrat will pay you much attention unless you might plausibly take away his job or budget.

Creating a person beyond the reach of the president in the executive branch would be like creating an unelected politburo in Congress to handle certain issues, or a special court completely independent from the Supreme Court to handle certain legal cases. Voters would see such actions as obviously unconstitutional attempts to weaken those pillars of democracy. So too is a theoretically independent Fed – an essentially fascist construct that purports to put monetary policy beyond the reach of the president, weakening the office held by the only man who represents all of the American people.

In recent years, the Supreme Court has consistently held that the president has the right to fire executive branch officials. It did so again last month in allowing Trump to dismiss members of supposedly independent federal agencies.

There was, however, a glitch. The unsigned order stated that: “The Federal Reserve is a uniquely structured, quasi-private entity that follows in the distinct historical tradition of the First and Second Banks of the United States.” This red herring in the court’s order implied its recognition of the president’s power to fire might not extend to the Fed.

In reality, there is nothing “quasi-private” about an organization that sets interest rates and decides how many dollars to print. Furthermore, the court should take note of another “distinct historical tradition” that began in Franklin Roosevelt’s administration of pondering packing the court with new justices when its rulings are at odds with the wishes of administrations and Congresses. It’s better to stick with what the Constitution means and says lest a flexible view of the Framers’ intent turn around and bite the court or Congress in their asses.

Furthermore, make-believe about an independent Federal Reserve was more believable when Fed chairmen took cues from presidents regardless of their political party. More recently, Fed bosses have joined the rest of the Deep State in seeking to help Democrats and harm Republicans. Firing Powell and dispensing with the fiction of his unfireability will be good for the economy, good for the presidency, and good for democracy.

This article was originally published by RealClearPolitics and made available via RealClearWire.