EIA: 10 counties in U.S. in Permian Basin account for 93% of domestic oil production

Ten counties in the U.S. – in Texas and New Mexico – account for 93% of domestic oil production in the last four years as analyzed by the U.S. Energy Information Agency.

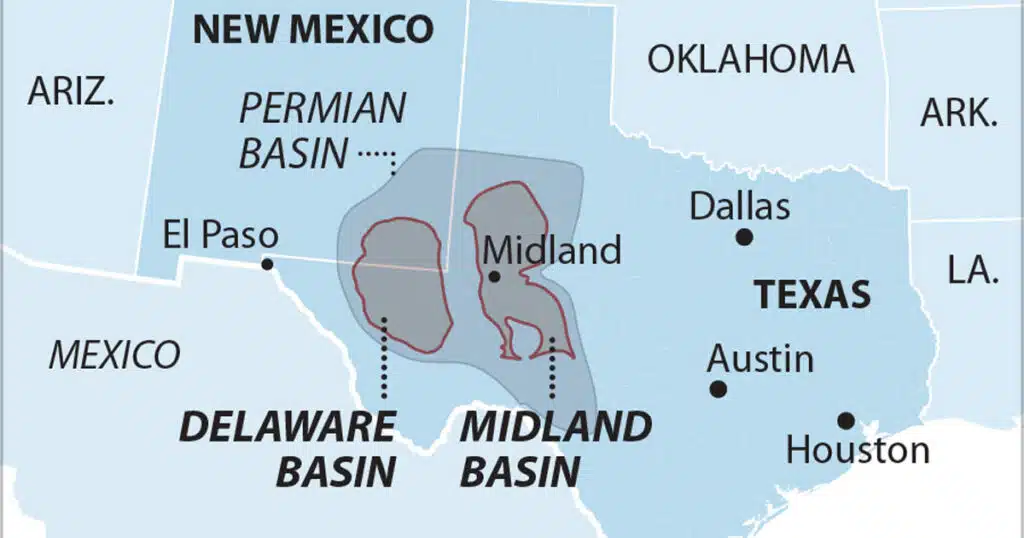

They are located in the Permian Basin in southeastern New Mexico and far west Texas, which produces roughly half of the crude oil and one fifth of natural gas in the country. The basin spans more than 86,000 square miles – roughly 10 times the size of New Jersey.

Roughly 250 miles wide and 300 miles long, it has more than 7,000 fields. The majority of production in the basin, 70%, occurs on private land in Texas.

Overall, the Permian Basin underlies 66 counties in New Mexico and Texas, the EIA notes.

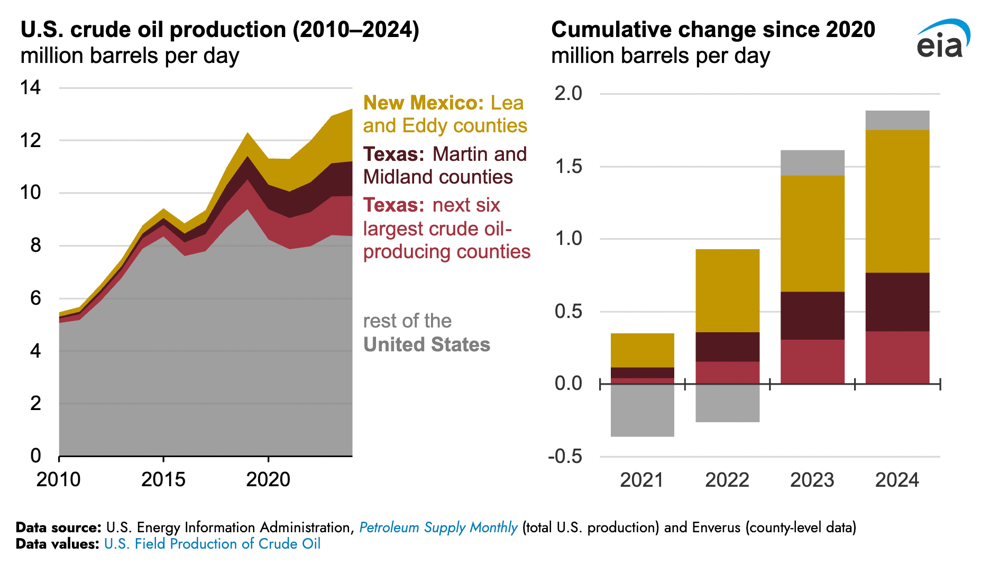

From 2020 through 2024, total crude oil and lease condensate production in the U.S. increased by 1.9 million barrels per day (b/d) in the Permian Basin – 93% of which was produced in 10 counties in Texas and New Mexico.

Two counties in New Mexico, Lea and Eddy, reported the greatest volume of production during this period, the EIA notes. They account for nearly one million b/d of U.S. production growth, or 52%, between 2020 and 2024, according to the EIA analysis.

Eight counties reporting the largest production growth are in Texas.

Martin and Midland counties accounted for an additional 0.40 million b/d, or 21%, of U.S. production growth; Andrews, Glasscock, Howard, Loving, Reagan and Ward accounted for an additional 0.36 million b/d, or 19%.

Last year, crude oil and lease condensate production in the 10 counties averaged 4.8 million b/d, representing 37% of the U.S. total, EIA says.

The primary geologic units located in these 10 counties are the Bone Spring, Spraberry and Wolfcamp formations. They “have been the main sources of oil production growth across the Permian Basin and the United States at large since 2020,” the EIA notes.

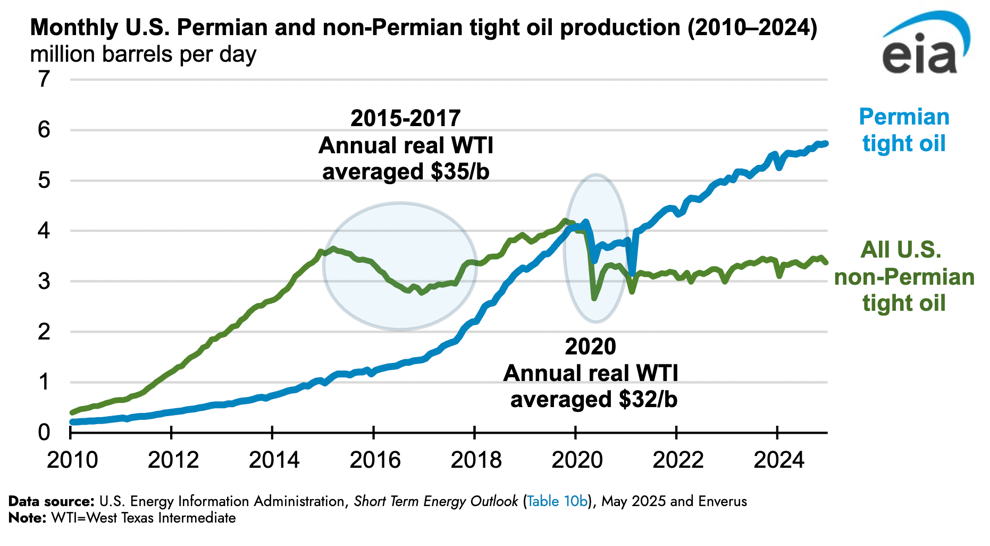

In a report released earlier this year, the EIA reported that onshore crude oil production in the lower 48 states more than tripled since January 2010, “driven by tight oil production growth in the Permian region.” This includes “legacy oil production, primarily from vertically drilled wells, and newer tight oil production, primarily from horizontally drilled wells.”

From 2010 to 2024, tight oil production increased from 0.8 million b/d to 8.9 million b/d; last year, the Permian accounted for 65% of all tight oil production growth and 51% of L48 oil production, the EIA explains.

As production increased in the Permian, methane emissions were dramatically reduced by more than 50% in the last two years, The Center Square reported.

A new S&P Global Commodity Insights analysis found that methane emissions reduction in the Permian “is equivalent to 11.1 million tons of carbon dioxide emissions avoided;” since 2022, “absolute emissions declined by 55.2 bcf, equivalent to 28.8 MMT of carbon dioxide emissions avoided.”

To put these numbers in perspective, S&P explains, “the 28.8 MMt CO2e reduction in absolute methane emissions over a two-year period” is roughly equivalent to the entire emissions reported from the country of Lithuania; “15% greater than the emissions avoided by all electric vehicles sold in the United States and the European Union;” “50% greater than the total emissions reductions in the UK power sector;” “equal to 2.2 billion trash bags recycled instead of landfilled,” and “greater than the greenhouse gas emissions from cooling and heating all the homes in California.”

“Our members have consistently demonstrated a sincere and deep commitment to reducing the level of methane intensity levels – efforts that are clearly working,” the Texas Methane & Flaring Coalition said. Since 2019, it says its operators “have made significant progress in ending the practice of routine flaring, and as this new data confirms, achieved extraordinary methane intensity reduction alongside record production levels.”

By contrast, production in the rest of the country, including offshore production in state or federal waters, increased by only 130,000 b/d, the EIA notes. This is largely due to a Biden administration nationwide policy halting new leases and permits on federal land and offshore, prompting multiple lawsuits.

The Trump administration reversed this policy, first announcing an offshore lease sale schedule in April now slated for December in the Gulf of America, The Center Square reported.

The Trump administration’s Bureau of Land Management earlier this year also announced lease sales on federal land initially in five western states, The Center Square reported.