The Fed’s Game of Chicken with the Global Economy

The game of chicken is pretty straightforward. Two cars drive directly at each other until one of them swerves at the last minute. If neither car backs off, a catastrophic head-on collision follows. Chairman Jerome Powell and the Federal Open Market Committee (FOMC) find themselves in one of the metaphorical cars, barreling down the highway in the direct path of the global economy, which is speeding in the opposite direction.

Inflation is a vicious beast that feeds on itself. Expectations for higher prices lead to stockpiling, which results in a spiral of ever higher prices. Traditionally, the Fed has used interest rate hikes to cool the economy and drive down demand.

To see exactly how past FOMCs addressed inflation at similar levels to what we’re experiencing today, let’s look at a chart tracking the fed funds rate (FFR) in the years when inflation exceeded 8 percent.

| Inflation (yoy) | federal funds rate | |

| 1973 | 8.7% | 9.0% |

| 1974 | 12.3% | 8.0% |

| 1978 | 9.0% | 10.0% |

| 1979 | 13.3% | 12.0% |

| 1980 | 12.5% | 18.0% |

| 1981 | 8.9% | 12.0% |

| 2022 | 8.3% | 3.3% |

With the exception of 1974, when Fed inaction allowed inflation to linger and fester, the FFR always closely tracked or exceeded the annual rate of inflation. Looking at 2022, it’s difficult to understand how an FFR that currently stands at 3-3.25 percent will affect 8 percent persistent inflation in any meaningful way. Even the Fed’s 4.25 FFR peak projection for 2023 would seem to be woefully short based on historical standards.

So, why hasn’t the Fed been more aggressive in raising rates and bringing inflation under control? Quite simply, they can’t. Unlike previous inflation challenges, this FOMC could trigger a global financial meltdown and a full-blown sovereign debt crisis in the United States by pursuing overly aggressive monetary and interest rate policies.

They are walking a very fine line.

Dangerous Debt Levels

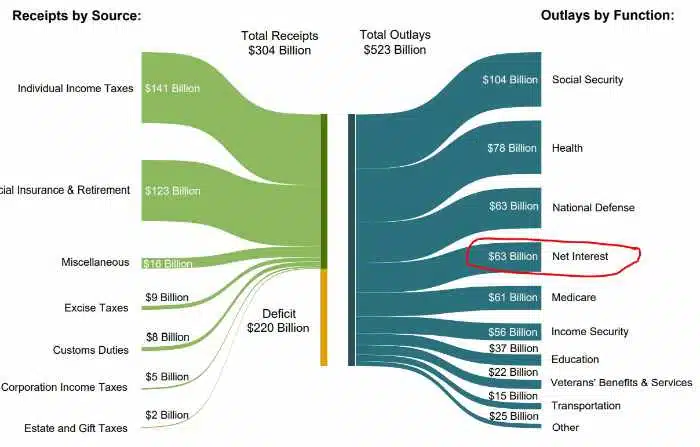

It’s worth looking at the August 2022 monthly Treasury report to understand how raising rates has affected the federal deficit.

At $63 billion and rising, the interest on the national debt is now the 4th largest monthly budget expense. By contrast, net interest in February 2022 was $32 billion and was the 6th largest expense. In June 2020, net interest was $19 billion and the 8th largest expense. From February to August, the effective FFR rose 2.15 percent, which essentially doubled monthly net interest costs.

Based on that trajectory, an FFR in the 4.25 range could push net interest above $100 billion a month, making it the largest single budget expense, ahead of even social security. One can only imagine the net interest payment costs if the Fed raised rates to 8 percent to tame inflation at our current levels. In light of massive, ill-conceived spending on climate and social programs, coupled with declining revenues, there is simply no way the Fed can raise rates above 4 percent for any significant length of time without risking a worldwide economic catastrophe. Given that choice, they must ignore inflation even if it remains unacceptably high.

A Global Sovereign Debt Crisis

A sovereign debt crisis is a situation where a country is burdened with severe economic and financial problems due to an inability to repay its public debt. Typically, the cause is tied to debt to GDP levels in excess of 100 percent, coupled with low or negative growth. In 2021, the U.S. had a debt to GDP ratio of 133 percent, which is expected to rise to 137 percent in 2022. We have also experienced two consecutive quarters of negative growth.

Emerging economies are even more affected by rising U.S. interest rates since these countries often own substantial dollar-denominated debt. As a result of a strengthening dollar, it takes more local currency to service the debt at a particularly difficult time when capital flows are reversing as investors look for safety in developed countries.

The Fed Must Swerve to Avoid a Collision

Cracks in the Fed’s resolve will likely follow increasingly harsh criticism from the global community. The United Nations Conference on Trade and Development (UNCTAD) has warned that if the Fed and other central banks continue to pursue a tight monetary policy while raising rates, the global economy could experience a recession much worse than the 2008 financial crisis. These fears were illustrated when the Bank of England was recently forced to intervene in the bond market and purchase $69 billion of long-dated gilts after a catastrophic sell-off.

Staring into an emerging financial abyss, the Fed will have little choice but to pivot on interest rate policy in the near future, especially when they evaluate the impact of the utterly psychotic economic policies coming from the Biden administration. Whether they fudge inflation numbers or simply give up and tell us it’s time for a “pause,” one is left to wonder just how much farther Powell can kick the can down the road when the road ends at a steep cliff just up ahead.