Interest Rates Are Soaring, Raising the Alarm for a Painful Reckoning for America

Someone with a million dollars of credit card debt probably wouldn’t celebrate if his interest rate skyrocketed. Yet some analysts are touting rising interest rates on America’s trillions of dollars of long-term debt as a good sign for the U.S. economy.

Are they right? Are rising long-term interest rates a good thing? Certainly not for anyone looking to secure a 30-year mortgage at two-decade-high rates. And certainly not for the federal budget. Not when America is sitting on $32.7 trillion in debt.

So why are some celebrating?

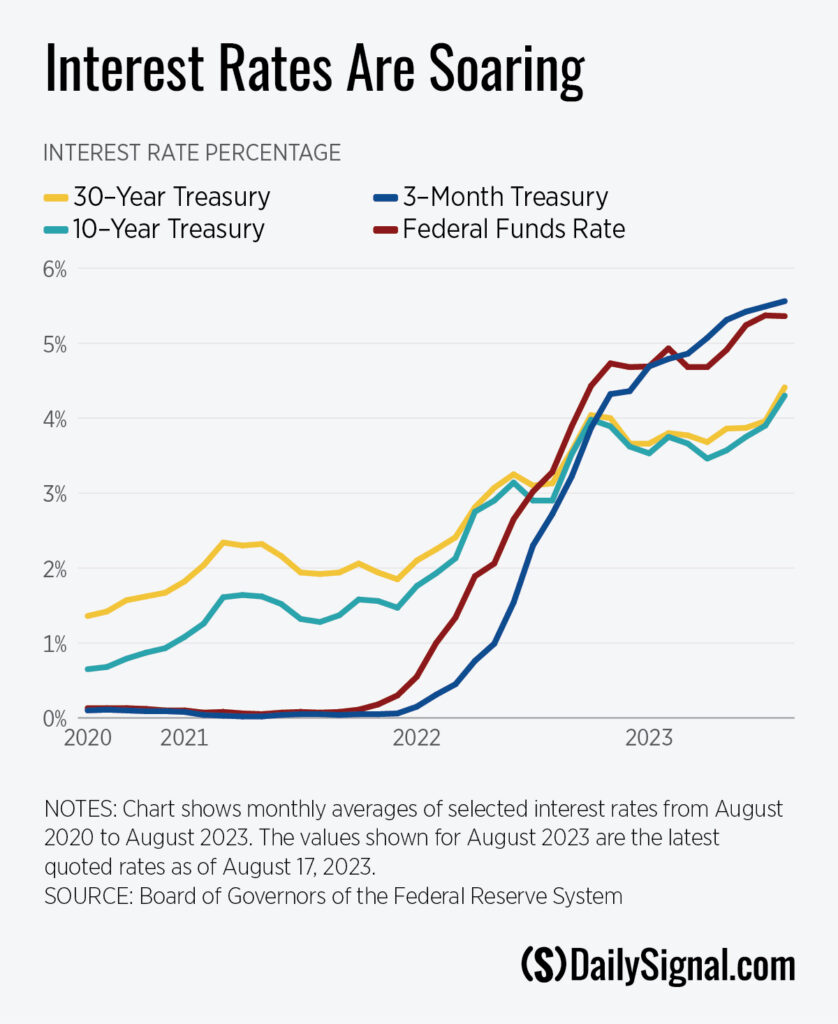

One of the most reliable indicators of a looming recession is when the rates on short-term Treasury securities are higher than those of long-term Treasury bonds. And for the last several months, that’s exactly what we’ve had: short-term rates much higher than long-term rates. This usually means that a recession is coming soon.

In normal times, the Treasury Department must pay a higher interest rate for longer-term bonds to entice investors to lock their money into, say, a 10-year bond rather than a more flexible three-month or one-year security.

But when investors expect a recession, they anticipate that the Federal Reserve will cut interest rates to try to stimulate the economy. This makes bondholders want to lock in long-term debt before rates—and bond yields—fall. Meaning they’re willing to accept lower interest rates on long-term debt than short-term debt.

Since May, but especially over the last month, interest rates on long-term Treasurys have risen much faster than rates on short-term Treasurys, partly closing the gap in rates. This could be because investors have become more confident that we’ll avoid a recession in the next year or so—so they don’t expect the Fed to cut rates. But it could also suggest that they’re more worried about a resurgence in inflation or the unsustainability of America’s deficits forcing the Treasury to pay more to convince markets to buy trillions more in federal debt.

There’s strong evidence for the latter: The federal budget deficit in the first 10 months of the 2023 fiscal year has more than doubled compared to the same period last year, increasing by 122%. On Aug. 1, one of the three major credit rating agencies, Fitch, downgraded U.S. debt from a AAA rating to AA+ specifically because of that soaring debt.

Deficits were higher at the height of the government response to the COVID-19 pandemic than they are today. But today’s deficits are even more troubling for two reasons.

First, at least in 2020, a case could’ve been made that large deficits were a one-off, temporary situation forced by a large negative shock to the global economy. But once that shock subsided, deficits should have come back to earth. Instead, it seems that deficits exceeding $2 trillion every year is the new normal.

The second reason that today’s deficits are especially problematic is because of the recent surge in interest rates. The near-zero rates that persisted from 2008 until 2021 kept in check America’s interest payments to service the debt.

But today’s soaring long-term interest rates indicate that such easy money is a thing of the past. For the United States, the world’s largest borrower, that’s a scary proposition. America will pay a hefty price for decades of fiscal recklessness. And the bill appears to be coming due sooner and steeper than previously anticipated.

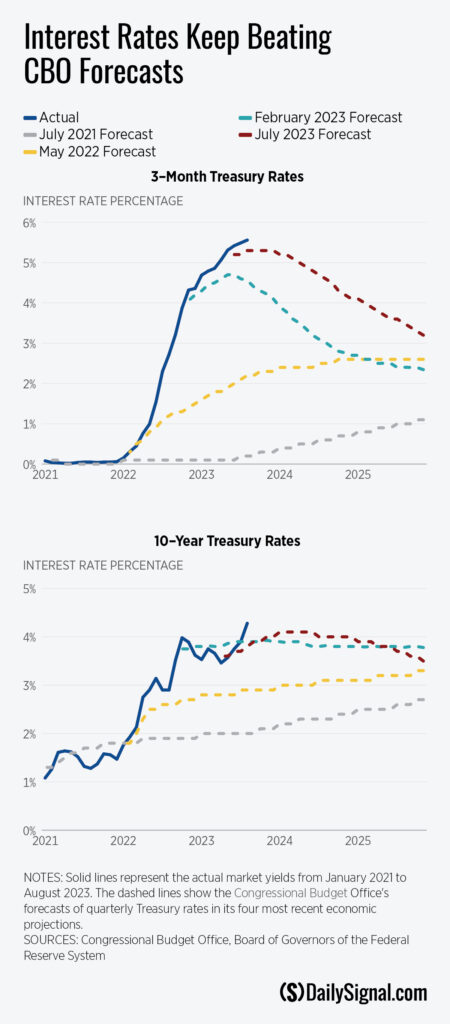

The chart above illustrates how America’s long-term fiscal prospects are even more dire than the Congressional Budget Office’s recent bleak forecasts have suggested. In recent years and months, the budget office has repeatedly revised upwards its interest rate expectations.

Net interest payments on America’s debt soared from about $350 billion in 2021 to nearly $800 billion today on an annualized basis. In March of this year, I warned that the budget office’s then-latest forecasts showed that the federal government’s net interest payments would surpass spending on national defense by 2028. But it’s been less than six months, and already net interest payments have surpassed spending on national defense over the past four months.

Even if interest rates remain flat, the cost of servicing the debt will rise as more and more of the old debt is rolled over into new debt at higher rates and, of course, as the government accrues new debt.

Based on the Congressional Budget Office’s forecast—which assumes benign 2% inflation and tame interest rates—by 2053, Americans will spend $5.4 trillion on net interest payments alone. That’s more than the total amount Americans now pay in all federal taxes. In other words, the feds could confiscate the entire economic output of the Great Plains region, and it would fail to cover the interest on the national credit card.

That’s an awful lot of taxes paying for no actual government services. And if interest rates keep marching upward, the interest burden could get out of hand much sooner.

The question then is this: Why would anybody expect interest rates on long-term U.S. debt to remain low? Would you make a low-interest 30-year loan to someone whose own calculations show his debt spiraling out of control?

The recent rise in long-term interest rates may suggest that a recession isn’t immediately imminent. But it also raises the alarm level for a painful fiscal reckoning. Financial markets are sending an ominous signal that it’s time for Congress to put its fiscal house in order.