How Stunning Oversights Could Cost Republicans the Midterms

Republicans may find themselves on the defensive in next year’s midterms not because of a leftist fabricated scandal but because of a pair of political misreads that cut to the heart of voters’ pocketbooks.

First, there is the unconscionable risk Republicans are taking in allowing the enhanced Affordable Care Act (ACA) premium subsidies to expire. Second, there is a failure to understand that a meaningful slice of the electorate are savers who like higher interest rates, and who are alarmed by the White House’s push to persuade the Fed to ease up. Together, those dynamics create a ripe environment for an electoral backlash significant enough that it might cost Republicans the House and Senate.

Typical Republican Procrastination on Obamacare

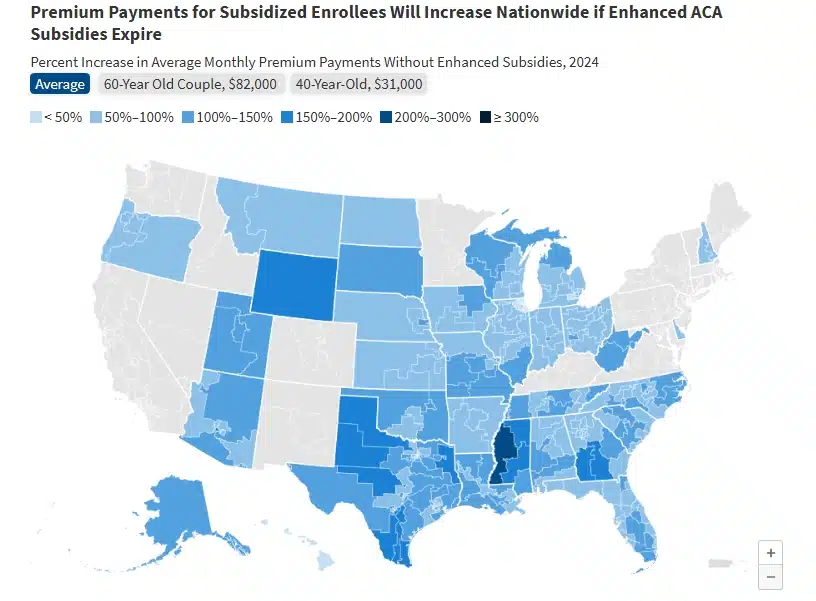

The health-care math is simple and brutal. Enhanced ACA premium tax credits that expanded affordability in 2021 were extended through the end of 2025. If Congress does not act, millions will face sharply higher premiums come January. Studies and trackers show the subsidies help roughly 20–24 million people and that premiums for many would more than double without them. Voters don’t separate abstract budget debates from how much they pay out for healthcare every month. When premiums spike, blame lands squarely on the party in power or the party that obstructed a fix. That political reality gives Democrats an obvious message: Republicans had a chance to protect affordable coverage and failed to act.

The worst aspect of the Obamacare mess is that it demonstrates a stunning lack of leadership on the part of President Trump and the leaders in Congress. Certainly, the president, along with the Speaker of the House, Mike Johnson, and the Senate Majority leader, John Thune, knew what was coming. Where was a plan that provided a meaningful alternative to Obamacare? They had 10 months to address the issue of the expiring subsidies. Were they so misguided they believed their negligence on healthcare would be offset by their successes in other areas?

Republicans could have used the Obamacare issue to their advantage by constructing a plan and then blaming obstructionist Democrats for shutting down the government, making it impossible to pass any legislation. Maybe Marjorie Taylor-Greene was right when she bitterly criticized Johnson for keeping the House out of session for 43 days during the shutdown.

The overriding point is that 20-24 million adults on Obamacare are really pissed, and many of them are small businesspeople or people in the gig economy, a core Republican constituency. I promise you that telling them they should ignore the spike in their health insurance premiums and focus on the president’s immigration and foreign policy accomplishments isn’t going to cut it.

When November 2026 rolls around, if ACA participants are still paying these elevated premiums, as shown on the map below, I can’t imagine they’ll be feeling very good about their Republican representatives when they enter the voting booth.

Trump’s Ingrained View of Interest Rates

As a developer throughout the vast majority of his adult life, Donald Trump has a deeply ingrained and unshakable belief that high interest rates are bad and low interest rates are good. When you build huge projects like Trump, a quarter point more on your construction loan can mean the difference between a successful or unsuccessful venture.

While Trump’s position on interest rates aligns with most economists, not everyone feels that way, especially retirees and younger people looking to build a nest egg. Income from savings accounts is a relatively recent occurrence since interest rates have been near zero for so long, but 13% of retirees now rely on interest bearing CDs, money-market funds, and savings accounts as a major source of income. Younger people have also enjoyed high-yield savings accounts, with 24% anticipating interest-bearing accounts would be a major source of income in the future.

Higher short-term yields have delivered tangible monthly gains for people living on interest income or holding large cash balances, and these are typically Republican voters who pay attention to what their bank statements actually say. Messaging that demonizes rates or frames lower rates as an unalloyed public good misses those constituencies.

I know, I know. Banks only offer higher rates on savings accounts in an inflationary environment, which means there is a net zero sum gain when you factor in inflation versus savings rates. While this is fundamental economics, a lot of people, especially retirees, don’t think that way. They like to see the tangible dollar number for the interest they earned on their savings account every month.

As for inflation, that’s more nebulous to them, and while they can’t get around paying more for eggs, they can either delay or eliminate the purchase of those new kitchen countertops if the price has gone up too much. In other words, they like the security of a reliable monthly income, and they’ll manage inflation through their purchasing decisions.

Unfortunately, the people that benefit the most from lower interest rates are often not aligned with the Republican party. I’m talking about the people with high credit card debt, high personal debt and difficulty qualifying for auto and home mortgage loans.

They may welcome the relief lower rates provide, but will it be enough to persuade the many Democrats in this demographic to vote for Republicans in the midterms? I have real doubts whether the enthusiasm of people enjoying lower interest rates will offset the anger and passion from those who are shelling out a lot more for health insurance while watching the interest on their savings shrink every month, especially when prices at the grocery store are still rising.

The Vulnerabilities Republicans Aren’t Taking Seriously

Political consequences flow from concrete losses: doubled health insurance premiums, squeezed retirees, and changes in monthly income. Midterms are low-turnout, high-detail elections where motivated constituencies, like ACA enrollees and income-sensitive savers, can swing close races. If Republicans are seen as having let subsidies expire, and voters perceive they are antagonistic to savers’ interests, the party’s map of vulnerable districts looks far worse.

Electoral outcomes are never preordained. But overlooking the subsidy cliff and underestimating the political power of savers is more than a policy mistake, it’s a strategic blunder. Fixing it requires fast, tangible action on the subsidies and a recalibrated message on monetary policy that acknowledges the real winners of high rates. Without that, Republicans risk turning two technical policy debates into a midterm twofer that costs them control.